If you haven’t already invested in a term plan, or if you’ve been wanting to, then this is for you. We’re going to be taking a look at 5 of the most important factors that you may consider before actually making a purchase. But before that, let’s quickly look at the answer to the question ‘what is a term plan?’.

What is a term plan?

A term plan is a type of life insurance policy where an insurance company provides the individual who purchases the plan, known as the policyholder, with a life cover for a certain period of time. The individual, in return for receiving the life cover, would have to make regular payments to the insurance company in the form of premiums. These premiums that the individual has to pay can easily be determined by using a term insurance calculator.

Now, if the policyholder were to die within the specified period of time, the insurance company would be obligated to pay a sum of money, known as the death benefit, to the deceased policyholder’s family or nominees. This death benefit payout can be used by the nominees to further their life goals or as they see fit.

However, unlike other types of life insurance policies, a pure term plan doesn’t come with any maturity benefits unless you opt for a plan with return of premium option. This means that if the policyholder were to survive till the end of the stipulated time period, there wouldn’t be any payouts whatsoever. And since a pure term plan offers only a death benefit, the premium for such a plan tends to be much more affordable compared to other types of life insurance plans.

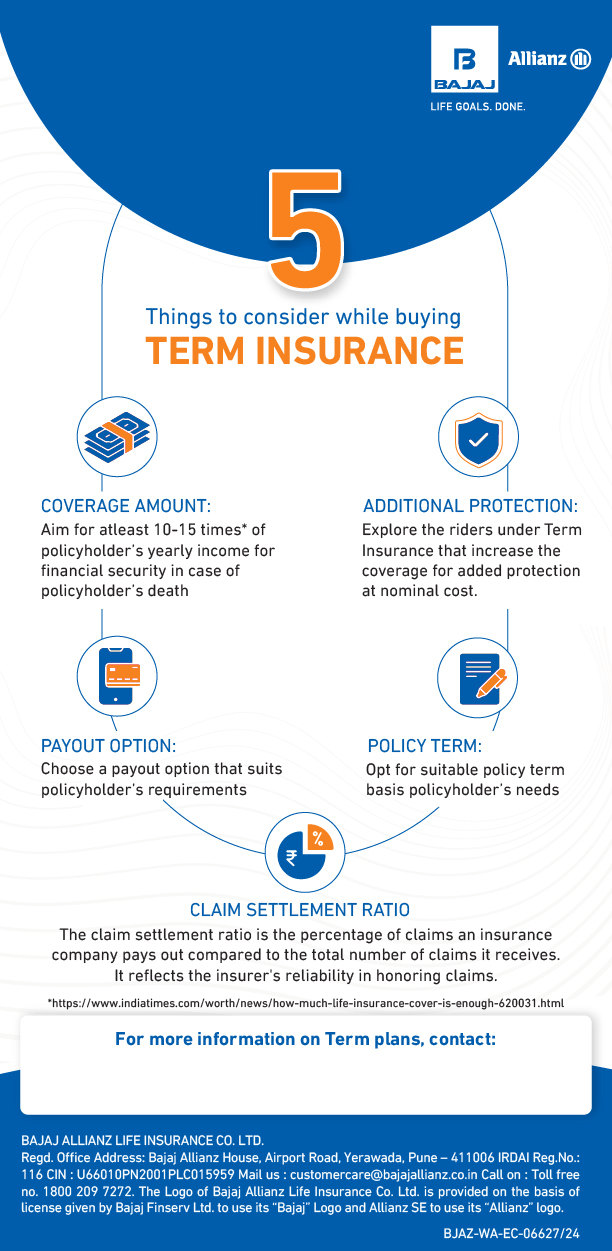

5 things to consider before buying a term insurance plan

Okay so, now that you’ve seen what a term insurance plan is in detail, let’s go over the 5 factors that you may consider before purchasing one.

1. Mode of purchase

First and foremost, you would have to decide upon the mode of purchase that you’re planning to go with. There are two choices - online term plans and offline term plans.

Of late, many individuals are choosing to go the online route for purchasing a term insurance plan. It not only gives them the flexibility to use a term insurance calculator to determine the amount of premium that needs to be paid, but also gives them the benefit of lower premiums.

2. The amount of insurance coverage

When you’re out to their Purchase Term Insurance, whether it is an online term plan or otherwise, this is one of the most important factors that you would have to carefully consider. The amount of insurance coverage may depend on factors such as your family’s life goals, your loans and liabilities, and your lifestyle expenses, among others.

The coverage that you opt for should be enough to meet all of the above-mentioned expenses and some more. If you’re finding it hard to decide, always go for insurance coverage that you can afford.

3. The tenure of the term plan

Another major factor that you should consider is the tenure of the term plan. Now, the policy term is fixed and cannot be extended later on. And so, it is important to choose the right term at the time of purchase itself.

The policy term that you choose should coincide with your age of retirement at the very least. Say you’re planning to retire after 30 years; your policy term may be 30 years. That said, don’t restrict yourself. If you can afford to opt for a longer term, consider opting for the same.

4. Riders

Riders are basically add-ons that you can choose over and above your base term plan. These add-ons essentially help enhance the insurance coverage of your term plan by providing you with additional benefits at nominal extra cost.

Accidental death benefit riders and critical illness riders are a couple of examples of the riders that you can opt for when purchasing an online term plan. No matter what rider you choose, here’s what you need to know. Riders tend to increase the amount of premium that you would have to pay. Therefore, it is advisable to use them judiciously.

5. The insurance provider

And finally, the insurance provider is another very important factor that you need to take into consideration. You have to exercise caution when selecting an insurer. Some of the factors that may be considered in choosing the Insurance Provider are their Offline And Online Term Plan offerings, their track record, claim settlement ratio, customer support etc. It is preferable to choose a provider with a high claim settlement ratio since it would mean that they honor most of the insurance claims.

Conclusion

Now that you have an idea of the things that you need to consider, go ahead and consider investing in a term insurance plan. It can help keep your family’s life goals alive even in your absence.

BJAZ-WEB-EC-00083/22